The director has been returned 79K already. Pay an employee 5000 and you end up with 595000 100000 495000.

The Double Entry System 2 Of 2 Accounting Notes Double Entry Accounting

If you take out a 100000 loan it shifts to 600000 100000 500000.

. This high-level equation is a summary of all the accounts that a double entry system uses. Other Income - Gain on derecognition of financial liability Would appreciate if you can give us your comment. This is because the company has already serviced this order in terms of processing the relevant goods and services.

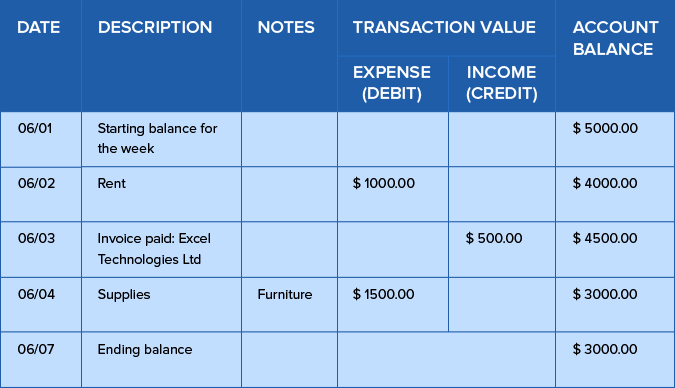

However due to the payment process and cash flow issue the payment is delayed. You pay a credit card statement in the amount of 6000 and all of the purchases are for expenses. Under the accrual method of accounting the above transaction will be.

In the books of Unreal Corp. The board of directors for Unreal corp. You must keep a record of any money you borrow from or pay into the Company and this record is usually known as a directors loan account.

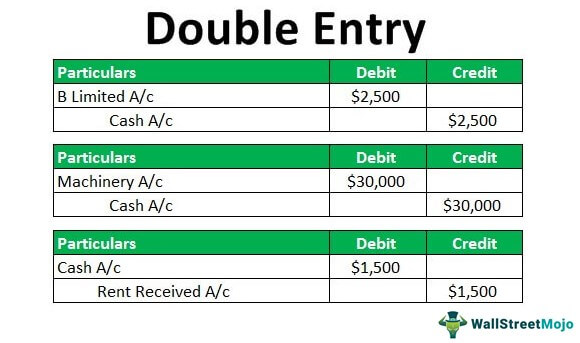

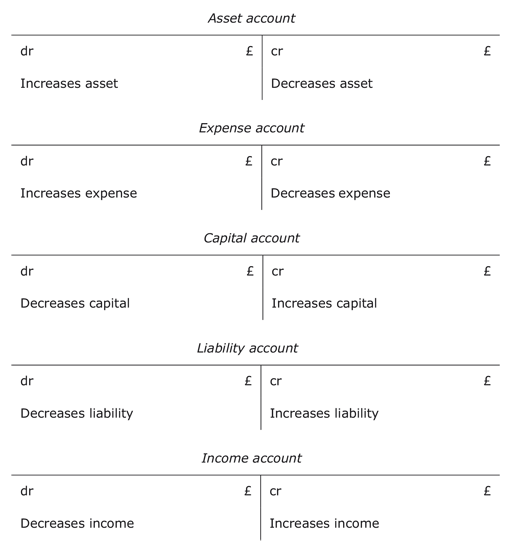

Overdrawn directors loan accounts is effectively an interest-free loan to the director and can have quite complex tax implications. How should the double entry be made to reflect that expenses been paid by the various shareholders are to reflect as. Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts.

Answer 1 of 6. For the firm what is the double entry for writting off the 21K director loan. The amount that is due from customers is also referred to as Accounts Receivable.

DEFERRED TAXATION The annexed notes form an integral part of these financial statements. The double entries is as follows. Amount due To Directors CR.

My boss ask me to to deduct the amount of share capital since the money come from both of the director and also from the other creditor. Corporation Tax S455 25 of the balance of any overdrawn directors loan account still outstanding 9 months and 1 day after the end of the accounting period. Amounts due to the director from the.

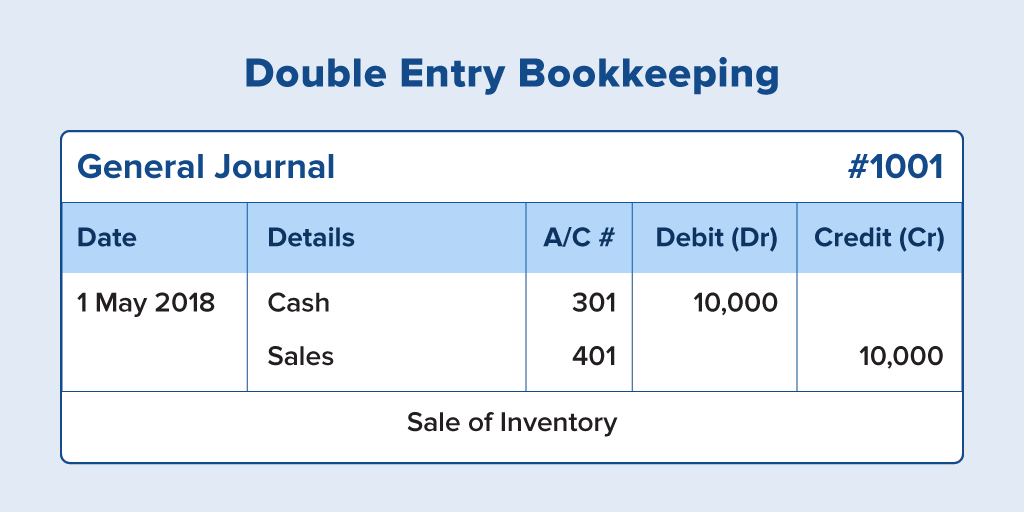

Double Entry for Directors Loans. The repayments I am recording as obviously the one credit the sum of the two debits. Companies develop a chart of accounts as the.

On 20 April the company has made a payment of 50000 to all directors. This is the representation of the debtors that the company has at a given. 1100628-TIncorporated in Malaysia 14 NOTES TO THE FINANCIAL.

The director may loan the company 1000 to pay a supplier or cover working capital requirements. Approved a payment package of 100000 per month including the bonus for one of its directors. Company 1 purchases goods from Company 2 on account credit.

AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment. It is the basis for modern bookkeeping. Transaction -any economic activity which results into change in financial position of the entity.

In this case one balance sheet liability account employee reimbursement has been increased by 200 reflecting the amount due to the employee. The director shares I can debit directors loan account and credit share capital. The entry is a total of 6000 debited to several expense accounts and 6000.

Purchase sale etc. Overdrawn DLA at Year End. On 01 April the company has approved the.

The DLA is a combination of cash in money owed to and cash out money owed from the director. On 01 April the remuneration committee decide to pay the 10000 to each director. CASA FOREST BIO WOOD MANUFACTURING SDN.

They put the money in the bank account. Ill publish in my next writing. If to credit income and the company is profitable this year any corporatoin tax to pay.

Commented May 14 2017 by Julita. The equation would look like 500000 0 500000. Hence we have present value the amount due to Director at zero value.

OK so the directors of a company have taken out a loan themselves that is used only for business purposes as they were unable to raise the money any other way. It seems an income will occur. A Directors Loan is when you take money from your business that isnt a salary dividend or expense repayment and youve taken more than youve put in.

Please prepare the journal entries for the remuneration package. A director lent 100K into a firm but the firm is always in loss and can only reply 79K. Show accounting and journal entry for directors remuneration at the end of the year if the payment is done via cheque.

The amount needs to be paid back in 15 days. Company 2 will record the sale as due from account and Company 1 will record the purchase in the due to account as they have yet to pay Company 2. He may also pay for several items of stationery and postage on behalf of the company using his own cash.

Cash in cash out. Credit that is due from customers is considered to be a current asset. Firstly to understand this U should know the difference between transaction and event.

The interest will be taxable under Section 4 c of the Income Tax Act. Event - it is a consequence or result of the transaction. In addition on the same side of the equation the expenses of 200 decrease the net income retained earnings and therefore owners equity in the business by the same amount.

The calculation of interest is simple.

Double Entry Accounting Accounting Basics Learn Accounting Bookkeeping And Accounting

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Loan Repayment Principal And Interest Double Entry Bookkeeping

Double Entry Definition Examples Principles Of Double Entry

Difference Between Single Entry System And Double Entry System Zoho Books

General Journal In Accounting Double Entry Bookkeeping

A Tutorial Doubleentryaccounting Org On Double Entry Bookkeeping And Accounting

Double Entry Journal Template Elegant Accounting Journal Intended For Double Entry Journal Template For Word Professional Template

Double Entry System Of Bookkeeping

General Ledger Accounting Double Entry Bookkeeping

The Fascinating 007 Accounting General Ledger Template Luxury Journal Entry With Regard To D Excel Spreadsheets Templates Spreadsheet Template Journal Template

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Double Entry Bookkeeping System Accounting For Managers

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

General Ledger Accounting Double Entry Bookkeeping

Double Entry Accounting Type Of Accounting Zoho Books

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

Accounting Transaction Analysis Double Entry Bookkeeping